February 2026 Mortgage Minute

Rates at a Glance

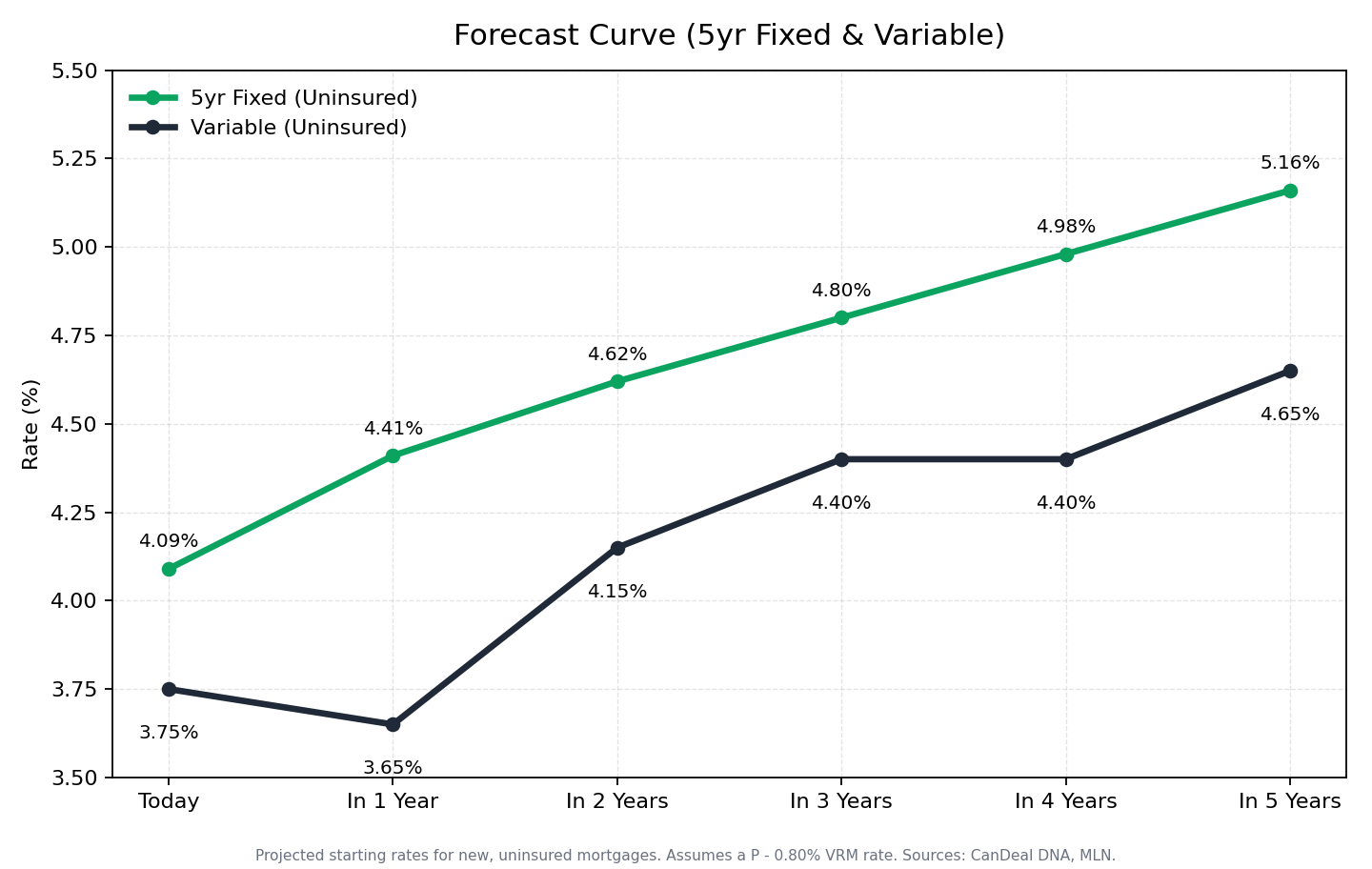

Current range: 3.65%–4.39% Where you land depends on term, LTV, and mortgage structure — we’ll explain.

Treading water: With both the Bank of Canada and the U.S. Fed on pause, markets aren’t pricing near-term cuts. Fixed rates aren’t sliding much.

Choppy, headline-driven: Trade, geopolitics, and oil are moving bonds week to week—expect bumps, not a smooth trend.

Inflation dips? The BoC is treating recent softness as temporary, so there’s no rush to cut.

Rate Probabilities (as of Feb 2)

Bank of Canada — Mar 18 Meeting:

25 bps cut: 2%

No change: 98%

U.S. Federal Reserve — Mar 18 Meeting:

25 bps cut: 19%

No change: 81%

Which Rate to Choose Today (Quick Take)

Need certainty? Locking a fixed rate is the safer play.

Comfortable with some risk? Variable is fine—just don’t bank on a big drop soon.

Model bias: Forecast models still favour 5-year fixed for now. The edge is modest, so choose based on penalties, portability, prepayment options, and time horizon.

This chart maps the expected trajectory of 5-year fixed and variable rates using today’s market pricing:

If you want a quick, plain-English read on rates or term choice, send a note—we’ll keep it simple.